[TRUTH UNVEILED] Rationale Behind Unity's New Runtime Fees

An industry-leading article tailored for the Unity community and "outsiders". It offers extremely in-depth, accurate, and digestible insights for Unity's rationale behind its run-time fee.

1. Background: Spilling the Truth; Challenging Misinformation

[Voiceovers are available across the entire article]

Amid the Unity pay-per-install controversy, there's been a significant surge in reactionary content creators spreading narratives laden with misinformation. This has regrettably led both Unity developers and those on the fringes of the industry to be misled by their false yet convincing narratives, characterizing John Riccitiello and Unity employees as “Capitalist Villains”.

Nevertheless, it is entirely understandable because it is only during Unity's Earnings Calls and financial report releases that we could get a glimpse into the true rationale behind the pay-per-install model and the financial challenges that Unity faces.

But let's face it. Most of us don't have time for these boring corporate talks.

And so, the purpose of this article is to provide a well-informed but digestible perspective (from earnings calls and financial reports) on the true rationale behind Unity's pay-per-install model. Off we go into the Minds of Unity Executives!

2. Unity is Burning Money: Financial Difficulties with Funding the Engine

IMAGINE THE CHALLENGE of creating and sustaining a versatile, general-purpose tool that must meet the intricate needs of diverse game genres (AAA fantasy titles to 2D hypercasual mobile games), serving both large conglomerates and small indie studios, spanning across industries like filmmaking, retail, architecture, and engineering, and needing to optimize the engine across 25+ platforms, including pre-release and old hardware versions.

Seems costly, doesn't it? But here's the remarkable part: Unity gives its cash-burning engine away to most developers FOR FREE.

As a consequence of its generosity, Unity commits a minimum of 50% of its total revenue and 2X its engine revenue (WOW!) to Research and Development (R&D) before addressing some rather “substantial” expenses, such as office leases, employee compensations, General and Administrative Operations, Sales and Marketing efforts, data center infrastructure, and tax responsibilities.

Furthermore, it's been disclosed that Unity’s engine only makes 0.4% of total gaming revenue from games built on it, even amidst the huge COVID-19 boost in game engagement when everyone worked from home. To put it in perspective, if a gaming studio generates $1000 using Unity, Unity's share of the pie would only amount to $4, despite investing ~$250M a year solely on R&D.

Given this context, is it truly unreasonable for Unity to seek additional revenue as a means of sustaining its operations?

3. Unreal Engine: Unity should just create their own “Fortnite”

Considering that, Unity only makes 0.4% of revenue from games developed on its engine, it's logical to suggest that Unity should create its own "Unity Fortnite" to bolster its income. And to be candid, this could have been achieved quite easily, especially considering that sample games like GIGAYA from Unity swiftly gained massive traction and earned loyalty among its developers in a short time span. However, a "Unity Fortnite" did not materialize, primarily due to John Riccitiello's empathetic decision to avoid directly competing with Unity's developer community. Regrettably, this commendable act went unnoticed, unappreciated, and unfairly portrayed as a "Capitalist Villain.”

Consequently, Unity unfortunately trails behind that of Epic Games (Unreal Engine) in revenue, prompting Unity to further invest in its engine to match Unreal's “Fortnite funding” so to remain competitive despite its financial strain. As evidenced by the graph below, Unity has to contend with Unreal Engine's Fortnite “money-printer”, which boasts 5-14X more revenue than Unity.

4. Unity Tried their Best: Revenue - Cost = Profit

In recent years, Unity pursued four product strategies in an attempt to improve its revenue:

Unity Create: Non-Gaming Digital Twins (AEC and retail industries) and Weta tools (Artistry and Film Industries)

Unity Grow: Unity Gaming Services (UGS) and its acquisition of IronSource.

So, which of the four strategies improved Unity’s income? Mainly IronSource (Best Decision ever), partly Non-Gaming Digital Twins.

IronSource saved Unity’s Finances and Growth story: Examining the shareholder letter below, acquiring IronSource was undoubtedly the best decision Unity has ever made. Without IronSource, their Grow Solutions (Unity Gaming Services) revenue growth would have dwindled to a mere 7%. Conversely, when we factor IronSource into the Unity's Grow Solutions Segment, it leads to an impressive year-over-year revenue growth of 157% (WOW!).

However, despite the massive investments in non-gaming digital twins and acquiring Weta Digital tools, Unity's year-over-year revenue growth achieved a bare 17%. On a positive note, non-gaming solutions (Digital Twins) now constitute 30% of the total Create Solutions revenue. Nonetheless, this also suggests that their game business is either experiencing a decline in revenue growth, either because macro-headwinds in the gaming industry (likely this reason), or Unity's game engine business is losing to its competitors.

Great news for Unity: Despite three out of four of Unity's strategies did not meet their revenue expectations, Unity ($949k) still exceeded Epic Games ($711k) in gross income this year, based on data from Statistica. This indicates that Unity's strategy, centered around expanding into new, unaddressed customer/developer demands and markets (referred to as the Blue Ocean strategy), has likely yielded positive results.

"I'm not going to ask you to increase our company's market share. In that case, you would look at the current market and competitors. But, I'm asking you to find a way to expand the available market." - Todd Stitzer, Chief Strategy Officer of Cadbury Schweppes

Personally, I believe this strategy will succeed, as expanding into entirely untapped customer bases and markets often leads to increased market share and growth in the overall industry pie (both gaming and beyond gaming).

Here’s a Case Study: P&G Blue Ocean Strategy: Reviving Olay

Here is a helpful, concise overview of each of the four Unity strategies (Audio Version is not Available for this Section):

Skip to Cost Section if Uninterested.

i. Unity Gaming Services (Excluding IronSource): A suite of user-friendly tools (some with one-click solutions), aimed at reducing the substantial complexity and effort required for developing backend solutions for games, such as…

Multiplayer: Multi-player game hosting, voice-chats, etc.

LiveOps: Enable User-generated content, player management, etc.

Analytics: Deep data analytics and dashboard on player insights, etc.

DevOps: Version control, automate multiplatform builds, etc.

ii. Non-Gaming Digital Twins (Unity Industry): A suite of tailored tools and services for the automotive, manufacturing, government, architecture, energy, and retail industries, such as:

Everything in the Unity Enterprise Editor: Build server, source code, extended LTS, etc.

Pixyz Plugin: Import and optimize CAD and 3D data, supporting 40+ file types and preserves hierarchy and metadata.

Unity Mars: Prototype, test, and quickly iterate to deliver AR content very quickly and easily.

Industry Success: Dedicated Unity advisors, on-demand training, rapid-response technical support, etc.

iii. Unity Weta Tools: A suite of industry leading VFX tools that are deeply integrated with the real-time rendering pipeline from Unity’s engine. It includes:

Ziva: Replicates organic physics and biomechanics of lifelike characters and creatures in real-time, etc.

SpeedTree: Create stylized and realistic vegetation easily, etc.

OTOY OctaneRender: Speed up the creation of realistic and high-quality 3D images and animations using GPU-accelerated rendering.

Additional Artistry tools: Wig 1.0, Eddy 3.0, etc.

iv. Acquiring IronSource: A suite of plug-in-play tools that help game developers to generate revenue and grow their user base. This segment represents the most profitable aspect of Unity's business.

Unity Monetization: Integrate and maximize ad revenue from games by letting multiple ad networks compete for impressions (LevelPlay mediation), in-app purchases (IAP), etc.

Unity Growth: Optimize game developers’ user acquisition strategies and campaigns (Luna), analytics for analyzing user behaviors, etc.

SuperSonic: Allow game developers to test, launch, and grow their games with data-backed, transparent insights and best practices.

Continue Here: What about Reducing Cost (Profit = Revenue - Cost)?

Earlier, I've presented Unity's attempts at boosting their income. Now, let's explore their attempts at cutting costs. Unfortunately, I believe Unity's cost-cutting measures have fallen short, as evidenced by their recent run-time fee announcement. Unity genuinely tried their best, the three rounds of layoffs (totaling 1100 job cuts) still resorted Unity to implement the new fee structure.

Personally, this implies that Unity will likely maintain a recurring and substantial cost structure in the future, particularly on its Research and Development (R&D) expense.

Following these layoffs, Unity has discontinued several of its products, including Unity Industrial Collections, Unity Reflect, and PlasticSCM, among others.

I personally consider this a positive move for the business because it allows Unity to concentrate its efforts on refining specific products into something exceptional, rather than spreading resources thinly across products that aren't profitable.

5. Unity Grow Solutions Losing to its Main Competitor: AppLovin

As mentioned earlier, IronSource played a pivotal role in preserving Unity's financial sustainability. Nevertheless, it is currently experiencing a decline in market share against a major competitor, namely, AppLovin.

AppLovin's recent surge in market share has raised concerns within Unity as it could indicate that AppLovin is excelling in user acquisition and now earns margins exceeding 100% (WOW!), leaving Unity Grow Solutions (including IronSource) trailing behind.

In the competitive landscape of advertising platforms, superior-performing solutions tend to dominate the market. For example, Matej Lancaric, a leading figure in user acquisition, has recognized that AppLovin's AXON Engine 2.0 (developed with Twitter's MoPub) has significantly enhanced AppLovin's user acquisition algorithm, propelling it into a leading position among the top 1-2 solutions for user acquisition. As a result, AppLovin’s precision in targeting high-value users that make tons of in-app purchases (“Whales”) has most likely led to its increased adoption and market share.

Source: Unity Special no.2: Boycott - Developers Fight Back in the mediation war - YouTube

And so, given that Unity’s Grow Solutions segment is crucial for maintaining its massive investments into the engine, Unity had no choice but to leverage its engine to subsidize its own Grow products, particularly on LevelPlay from Unity Gaming Services. Thus, serving the underlying rationale for the run-time fee subsidies for LevelPlay.

Personally, if AppLovin maintains its current momentum, Unity could lose its sole source of engine funding and face the risk of bankruptcy. It is an existential threat to Unity, which is why it is subsidizing its runtime fees for developers using LevelPlay, a direct competitor to AppLovin's MAX platform.

6. Game Studios are Consolidating: Pessimism about Indies and Small Studios

ENVISION YOURSELF as a small indie studio, pouring years of effort into a heartfelt mobile game project alongside a dedicated group of friends. However, upon its release, the game falls short of the anticipated success. It struggles to garner even a handful of downloads amidst the overwhelming presence of AAA mobile games supported by trillion-dollar corporate giants, the recurring flow of sequels from major studios built on established franchises, and an indie scene flooded with new titles. Adding to the challenge, there's a decline in the number of players making in-app purchases compared to previous years, causing games to become less profitable. It seems rather daunting, doesn't it?

This unfortunately is an accurate depiction of the current, depressing state of the gaming industry, which negatively affects Unity majorly indie developer base the most.

i. Big Tech and the Entertainment Industry are Entering into Gaming

Backed by trillion-dollar conglomerates with colossal money-printers and an abundance of engineering talents, big tech is using their popular IPs to venture into the gaming industry. For example, due to poor macro-conditions in the streaming industry (and entertainment industry as a whole), Netflix is entering into both AAA titles and mobile games with its highly successful IPs, such as Squid Game and Stranger Things. Microsoft has also successfully acquired Blizzard under its umbrella, gaining access to chart-topping, billion-dollar IPs like Call of Duty and Overwatch.

These conglomerates entering into the gaming industry will create more competition against small indie studios, which is Unity’s largest developer base.

Source: Netflix sets its sights on video games for its next chapter as growth slows for the streaming giant

ii. Large Studios are Encapsulating their Players within their Ecosystem of Games

Indie developers find themselves in an ever-increasing, uphill battle with mobile gaming industry giants like Voodoo, Supercell, and Nintendo, renowned for their valuable intellectual properties (IPs). Moreover, there's a notable trend of major studios extending the lifespan of their well-established IPs, overshadowing lesser-known indie titles.

Furthermore, when a game from a major studio succeeds, it gains the financial means to expand and create more titles. This empowers them to cross-promote their games through in-app advertising, establishing a continuous cycle that keeps players within their gaming ecosystem while limiting the visibility of mobile games from smaller indie studios.

Personally, this cross-promotion practice will ultimately lead to a scenario where only a handful of major studios or publishers can dominate the top charts.

Top charts, especially in Hyper-casual genre, are already dominated by several Large Publishers:

iii. Players are spending less, but Games Releases are Accelerating: Supply >> Demand

Additionally, while the market is flooded with an increasing number of games, in-app purchases are dwindling, resulting in an oversaturation of games but a shortage of players willing to spend money.

And so, games become less profitable over time, and Unity's original strategy of pushing indie developers to upgrade to Unity Plus/Pro after reaching $100,000 in revenue is no longer financially viable. Consequently. Unity must adapt its engine’s business model and introduce its new run-time fee to ensure it doesn't lose its already tiny 0.4% revenue share.

Personally, Unity losing its already tiny 0.4% revenue share could potentially pose an existential threat to its engine.

iv. Unity Attempts to Win in this Ever-Consolidating Mobile Gaming Industry

Against huge game publishing giants, especially in the hyper-casual mobile genre, Unity’s SuperSonic is actively empowering its developers to thrive in this ever-consolidating gaming market. Remarkably, SuperSonic's performance remains truly exceptional even without introducing its run-time fee and provide subsidies for all Unity games published under the SuperSonic umbrella.

For example, in less than eight months (from 29th December 2022 to 26th August 2023 based on the Wayback Machine), SuperSonic managed to garner 600M downloads, 16 more games published, and a whopping 89% of those games managed to reach the Top 10 charts (WOW!). This means that most Unity games partnered with SuperSonic have achieved chart-topping success.

And so, introducing and subsidizing its runtime fee for SuperSonic-partnered Unity developers will further empower SuperSonic to gain market share against massive publishing giants. The massive and immediate push-back from these publishing giants is likely a direct response to the subsidies and ever-widening gap between SuperSonic and the dominant game publishers:

Personally, I believe Unity introducing its run-time fee will pressure the entire mobile gaming industry to create games of higher quality with improved user retention and in-app purchase performance. Every game studio must now weigh the potential losses incurred during each user acquisition.

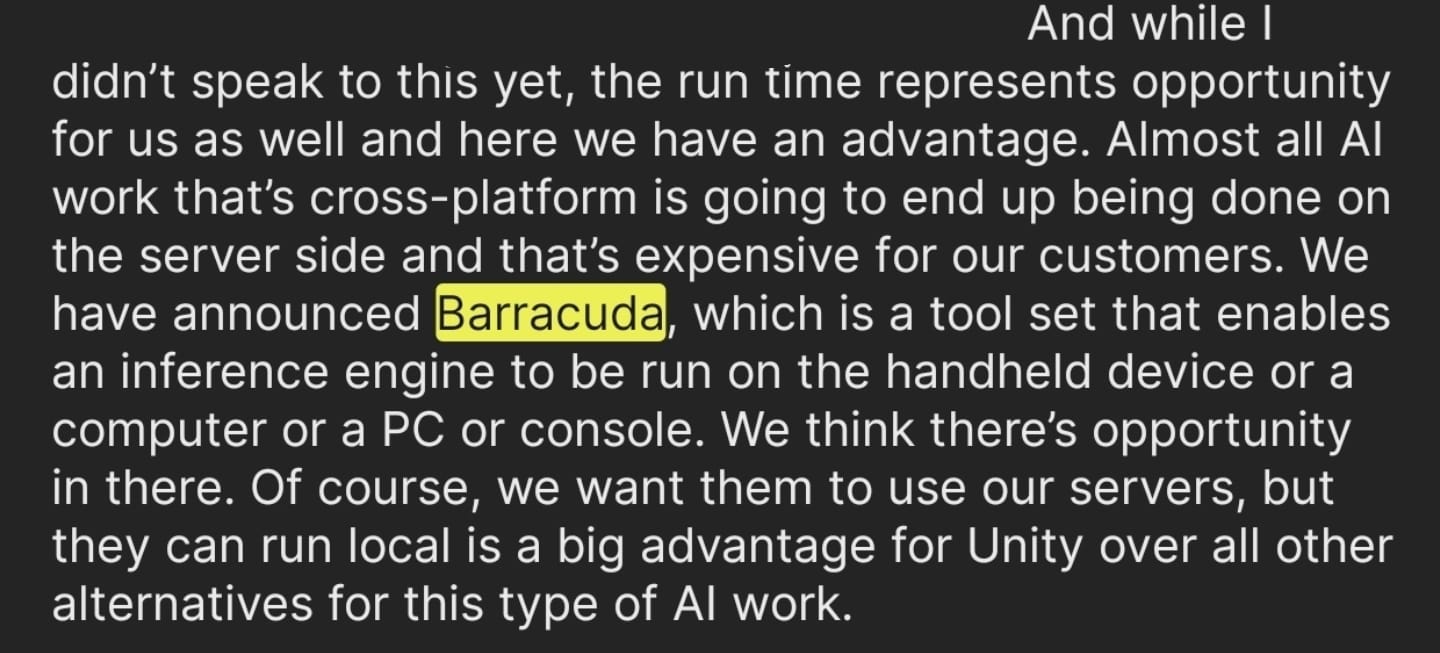

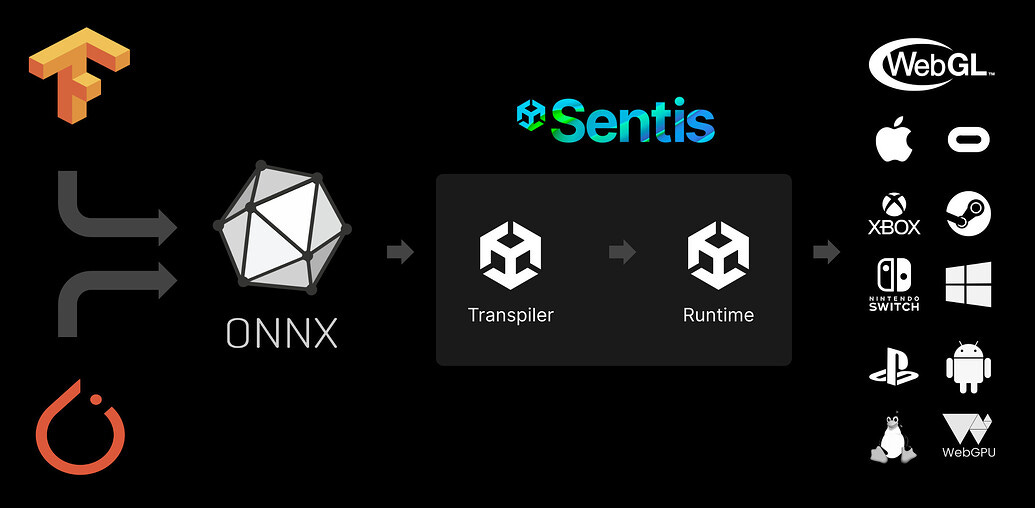

7. Unity Sentis Run-time>>Everyone else: Unity’s Guaranteed Win in Ai

Envision a groundbreaking tool that empowers game developers to effortlessly incorporate multiple AI models while maintaining a smooth 50 frames per second real-time gameplay across 25+ optimized platforms, from cutting-edge XR headsets and legacy mobile devices.

Sounds alluring, right? However, it raises some pressing concerns:

Skyrocketing Cloud Costs: Deploying AI models places an immense strain on cloud resources, resulting in prohibitively high expenses. Scaling these AI-powered games to serve millions of users only exacerbates the financial burden of maintaining robust cloud servers.

Network Limitations: AI-driven games may be constrained to smaller user bases due to bandwidth limitations and network dependencies, particularly in regions with poor internet connections. These constraints risk causing lag in the performance of AI models, hindering the seamless real-time gameplay experience.

Data Privacy Concerns: Running these AI models requires user data to be stored and transferred to the cloud, raising massive privacy risks. Few would be comfortable with an object and body detection AI model tracking our every move.

Enter Unity Sentis Runtime—an absolute game-changer. Sentis introduces an unlimited AI inference engine that leverages the computational power of end-user devices across 25+ platforms Unity optimally supports to run AI models, eliminating the need for costly cloud servers with high-end GPUs. This Unity solution not only avoids cloud expenses but also ensures a smooth real-time gaming performance, all while enabling private neural network inferences (WOW!).

Furthermore, Unity Sentis Runtime stands unequalled in the market. No other solution currently offers the capability to run multiple AI models simultaneously on local devices, seamlessly integrated into its runtime, optimized across 25+ platforms, and be provided free of charge to all Unity developers.

Hence, as Unity currently stands as the industry leader in the real-time AI inference engine domain, it justifies the reasoning behind charging a premium for its engine. Conversely, introducing a runtime fee, rather than a dedicated "Sentis fee," reflects Unity's commitment to empowering developers to experiment and leverage Sentis for creating the next generation of innovative AI-powered games.

I believe Unity Sentis will emerge as the sole key enabler for the future of free-to-play AI-powered mobile and XR games applications. Achieving a cost-free AI-powered gameplay would remain an unattainable goal without eliminating cloud compute expenses completely. Additionally, private inferences will eventually emerge as a critical component of XR applications, as majority of those apps demand non-stop object and behavior detection.

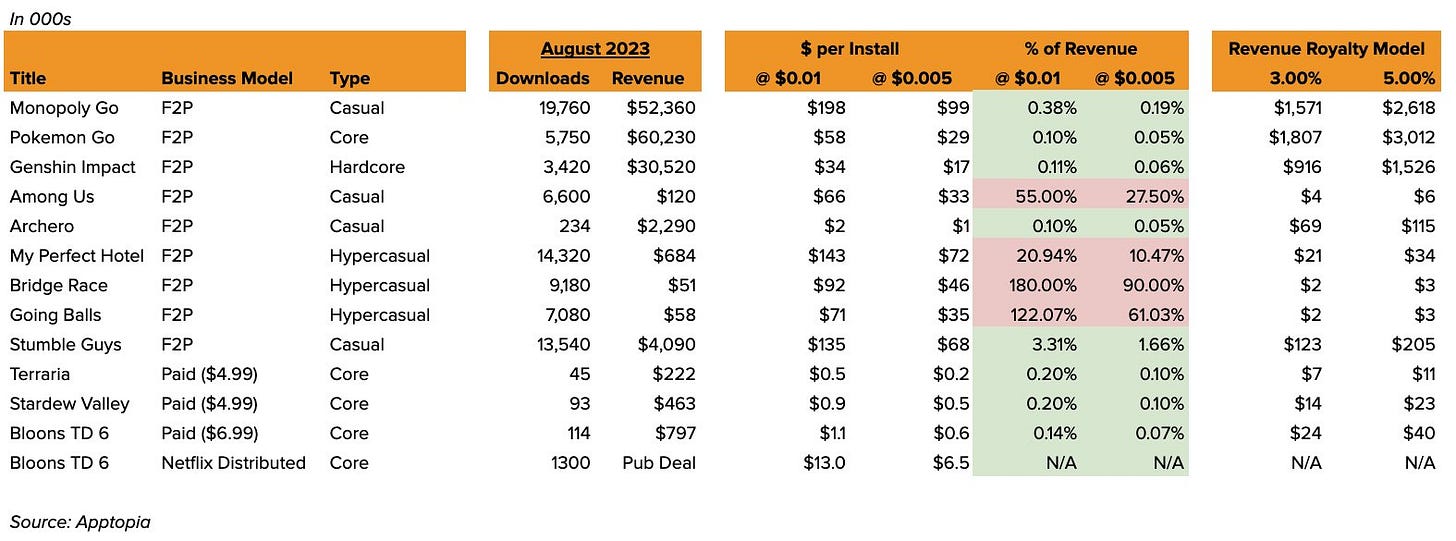

8. Pay-per-install Fee vs Revenue Share Model: Which is more Developer Friendly?

Last but not least, in concluding our discussion on the run-time fee, we need to address a crucial question: Why did Unity opt for a pay-per-install fee instead of a revenue share model? The answer, it depends.

"We think it (pay-per-install fee) is going to be cheaper (than revenue share) for a lot of games. So, we're trying to build a model that we think is fair and a good value exchange that works once games find a level of success. And we also want to tie it to the value that Unity brings, which is the run-time inside the games themselves. And so, it felt like a way we could tie those two pieces together and we think in a pretty reasonable number of cases that that's a smaller number. And we think that's good." -Marc Whitten, Fireside Chat

Biggest Beneficiaries: AAA titled and paid-PC games.

For these categories of games, the flexibility lies in the ability to sell games above $60 or offer Free-to-Play (F2P) games with a guaranteed minimum Lifetime Value (LTV) of $0.01 per player (esp., for pre-purchase games). Notably, AAA PC titles benefit from prolonged game lifespans facilitated by regular content updates and low churn rates, given the higher friction associated with uninstalling PC games compared to mobile games.

However, adopting a revenue share model proves unattractive for these games, especially those featuring user-generated content. In such cases, sharing a portion of their revenue with player creators diminishes their profit margins, making it an unfavorable prospect.

Most Disadvantaged: Hyper-Casual Mobile Games

Hyper-casual mobile games will be most affected by a pay-per-install fee, given their business models are characterized by high download volumes paired with low Average Revenue Per User (ARPU). On the other hand, these games frequently utilize Unity LevelPlay/Ad Network (for In-App Ad Monetization) and Luna (for User Acquisition), so the fees would have been subsidized or eliminated entirely.

Viral Hits: Among Us

One might argue that viral sensations like Among Us would suffer under the new pay-per-install model. However, I personally disagree with this argument as there are massive potential for Among Us to introduce in-game ads to its extensive user base, generating substantial revenue. Nevertheless, acknowledging potential exceptions, it's crucial to highlight that Unity's pricing revisions now incorporate a new revenue share cap, adding a layer of fairness and flexibility to the equation.

Conclusion

In summary, Unity's run-time fee stems from extensive R&D costs (2X Engine Revenue), limited engine-generated revenue and cost-cutting, strategic initiatives to empower developers, efforts to monetize Unity Sentis, and a preference for pay-per-install over revenue share. After reading this article, I hope that I've managed to empower you (the readers) with industry-leading insights into Unity's rationale for its run-time fee. Thank you so much for reading :)

What’s Next: I'll create two more distinct articles tailored for different audiences: Individual Unity executives and Shareholders/Investors.

a/ Unity Shareholders: An in-depth analysis of the impact of Unity's new pay-per-install pricing model on its business fundamentals, and Unity’s current and lighthouse vision and strategy, i.e., Building the next AWS.

b/ Individual Unity Executives: Constructive and thoughtful advice for each Unity executive management in improving Unity’s execution, esp., on PR, strategies in building MOATs, hiring, etc.

Feel free to follow my LinkedIn Profile (personal growth-related) and Substack Newsletter (finance, business, XR, and beauty-related) for more groundbreaking articles ;)